Let’s face it. The most important task for a freelancer is not creating great work for your clients. It’s actually keeping track of your income and expenses so that you can stay in business for the long haul. After experimenting with a variety of accounting tools, I’m here to tell you that QuickBooks is the perfect bookkeeping tool for freelancers.

Based on my years of experience being both a freelancer and a self employed content creator, I know that QuickBooks has all the features I need (and more) to help me run a profitable business. It’s smart, easy to use, and most importantly: cheap.

Which version of QuickBooks is best for freelancers?

The biggest problem I have with QuickBooks is the fact that it’s a massive product line with many different versions. In comparison, FreshBooks (it’s main competitor), is just “FreshBooks”. It’s excellent accounting tool for freelancers, and I’ve actually used it in the past with great results. However, I just couldn’t resist going back to QuickBooks. More specifically, QuickBooks Self Employed.

| Please note: some of the links in this article may be affiliate links. This means that I will get paid a commission if you buy something or take an action after clicking one of them. |

QuickBooks Self Employed has all the tools that freelancers need to stay on top of their finances:

| Automatic income and expense reporting |  |

| Powerful invoicing tools |  |

| Tax organization and assistance |  |

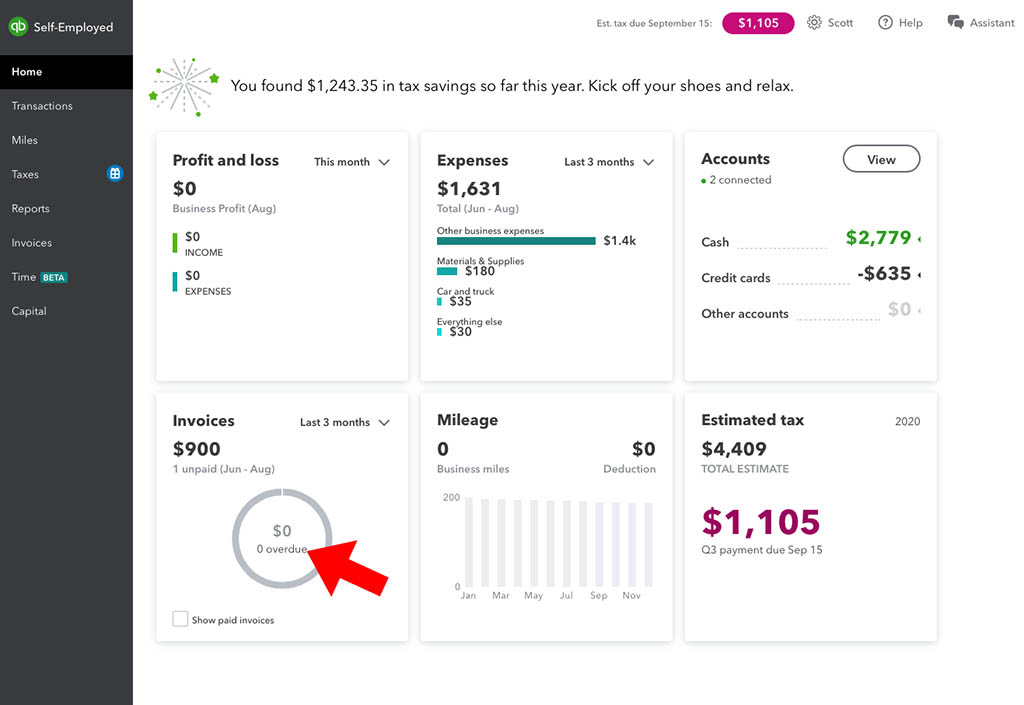

| Useful charts and graphs to help summarize the status of your business |  |

| Full-featured mobile app for both iOS and Android |  |

| It's cheap! | $10/mo |

There’s a lot more to it than that though, and the best way to tout its benefits (and shortcomings) is to look at all these features in greater detail. But first, let’s take a look at the pros and cons of using QuickBooks Self Employed for freelance work.

All the pros and cons for using QuickBooks to manage your freelance business

For the record, this pros and cons list is based on my own experience. For hose that don’t know, I am a self-employed content creator who does freelance work on the side. QuickBooks Self Employed is a vital part of my business, and I’ve got loads of experience with the software in a variety of different use cases.

Pros

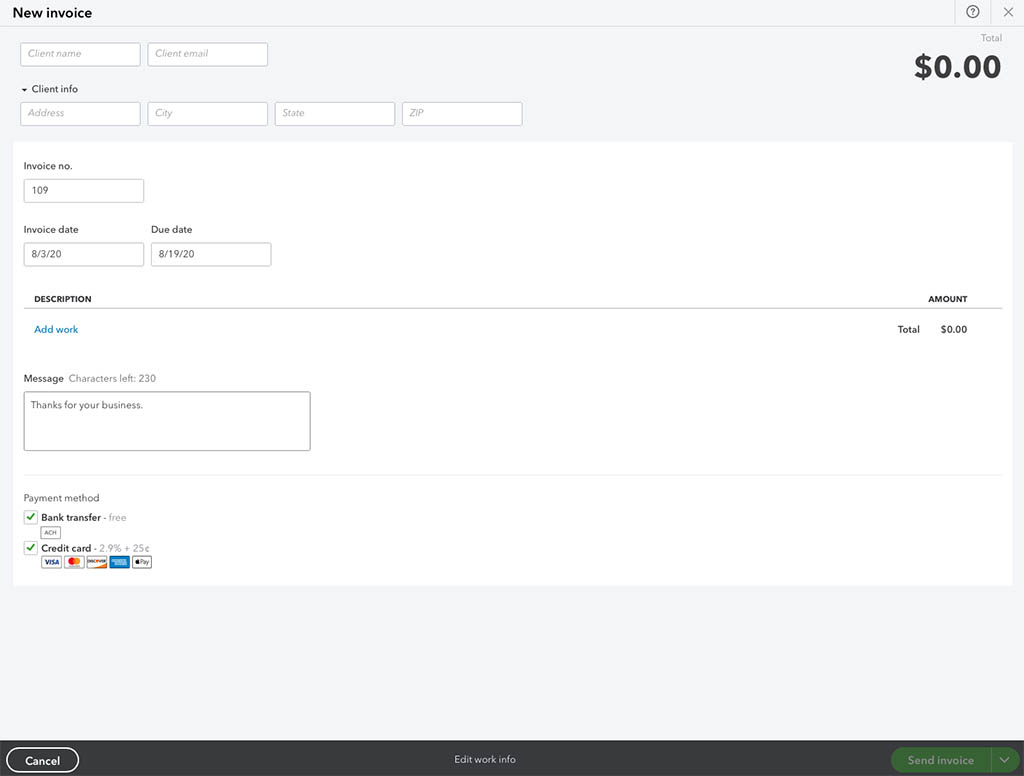

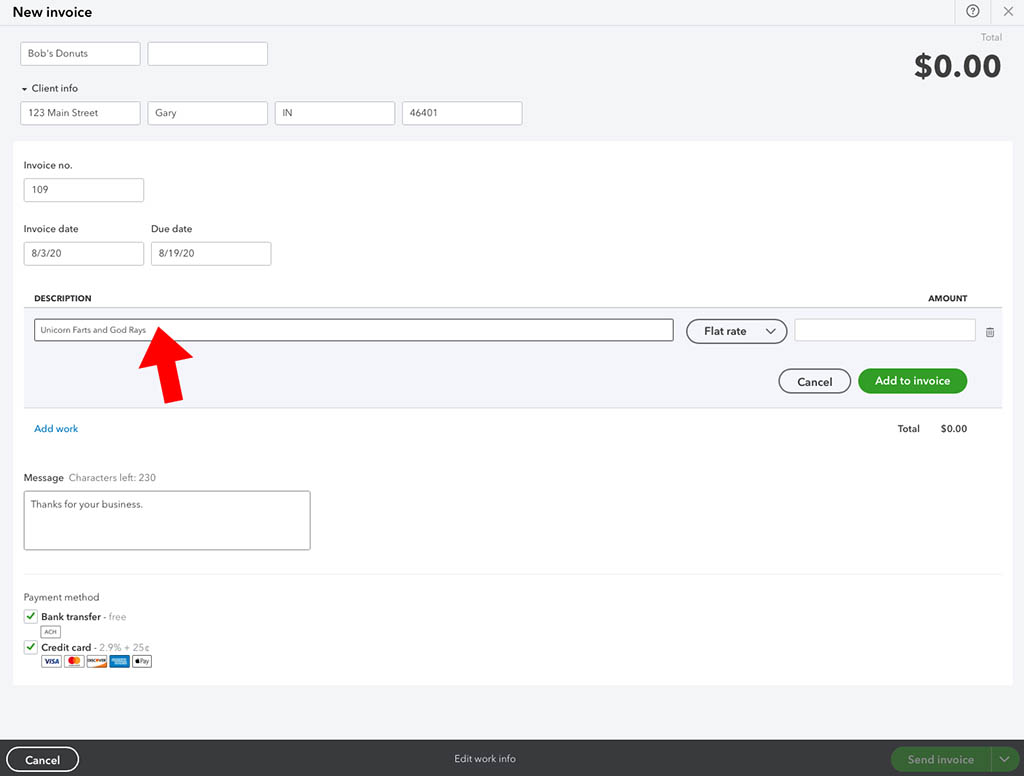

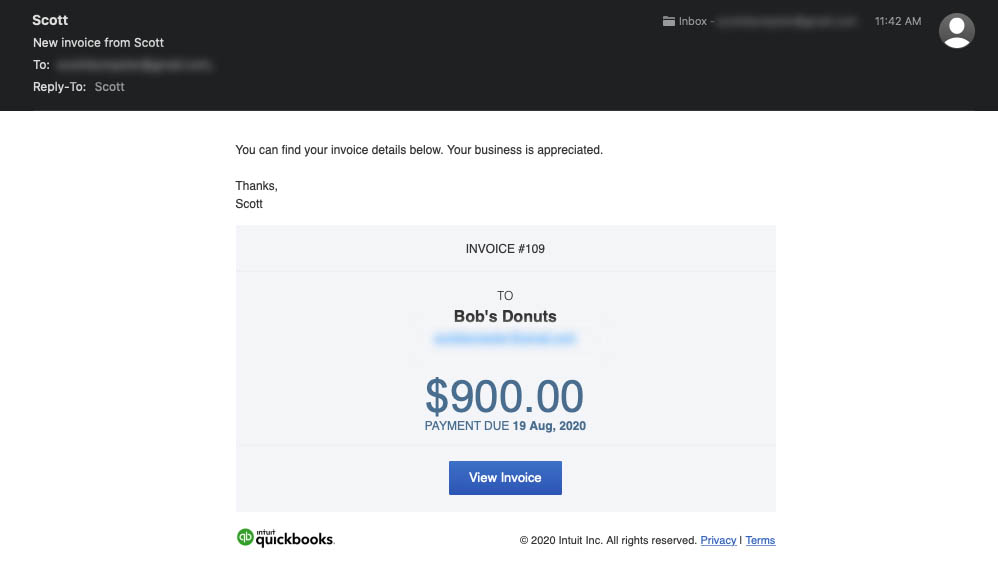

- The biggest advantage to using QuickBooks for freelance work is (by far) the powerful invoicing features. The invoices you send from QuickBooks to your clients is all that you need to get paid. Your clients simply click the link on the invoice to pay, and QuickBooks takes care of the rest.

- It’s extremely simple. As a freelancer, you need to be focused on your clients and the work you’re doing for them. Tracking your income and expenses is important, but it takes time away from billable work! With QuickBooks Self Employed, you can connect your bank and credit card information directly to it so that all income and expense data is automatically imported and sorted. You don’t have to do anything.

- It’s an incredibly good value. I’m currently paying just $10 a month for what essentially saves me weeks worth of work every year when it comes to tax time. It’s basically just like having a really good accountant that you’re only paying $10 a month for. I almost feel guilty about paying so little.

- Speaking of saving time when it comes to taxes, QuickBooks Self Employed is a godsend for freelancers who have problems with accounting. Yep, and this is a profession where taxes can get messy really fast if you don’t know all the rules, and it’s nice to have QuickBooks there on your side organizing things throughout the year so that you’re ready to pay taxes when it’s time.

Cons

- The main problem that I have with QuickBooks Self Employed in regards to freelance work is that it’s a bit clunky to organize income and expenses (and invoices) by client. Conversely, FreshBooks is better with managing clients, and it’s probably the tool and want to be using if you’ve got an extremely long and diverse client list.

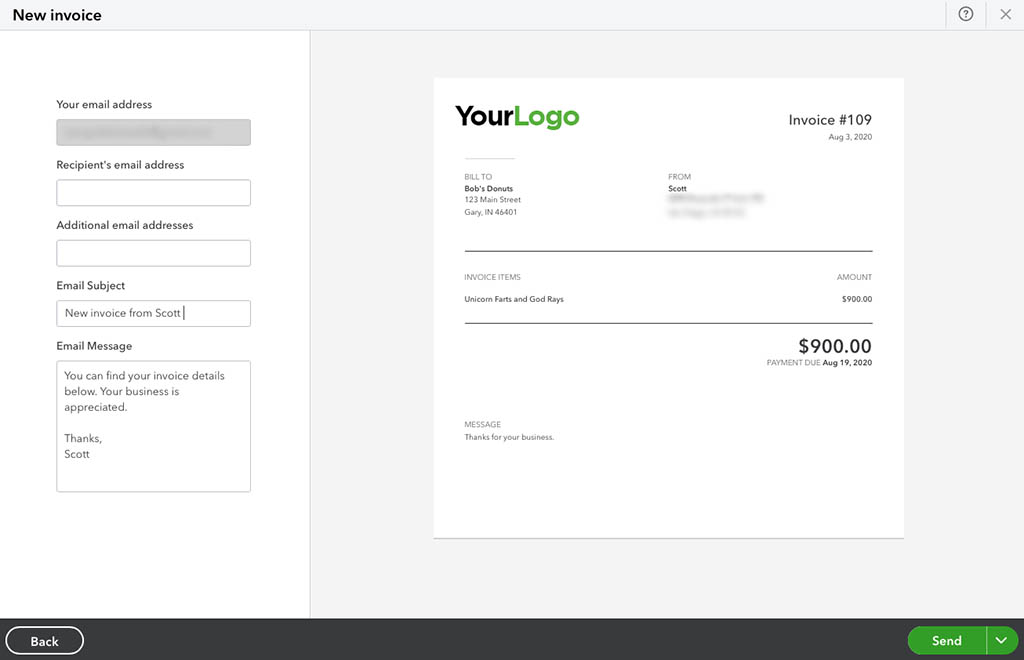

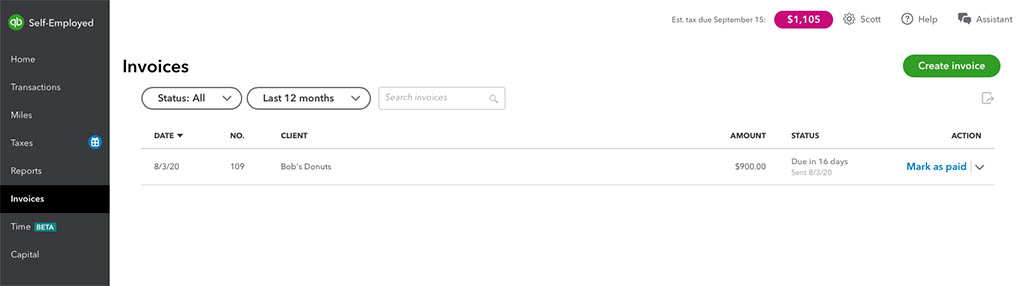

How does the invoicing system work?

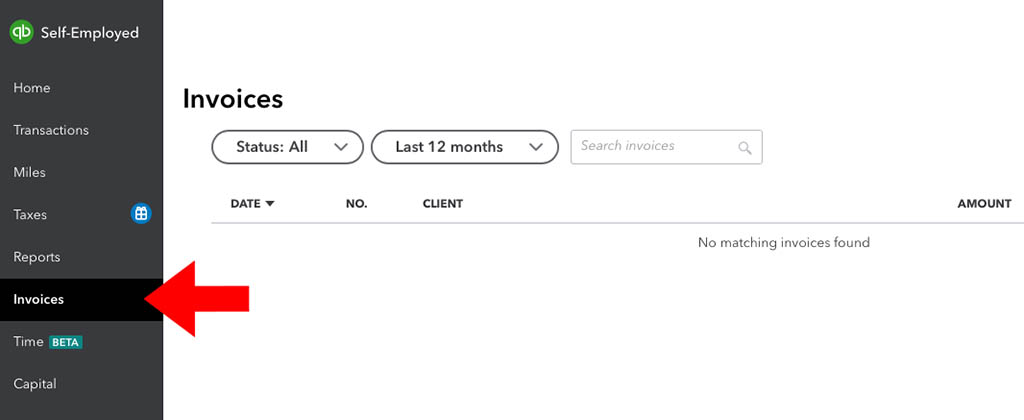

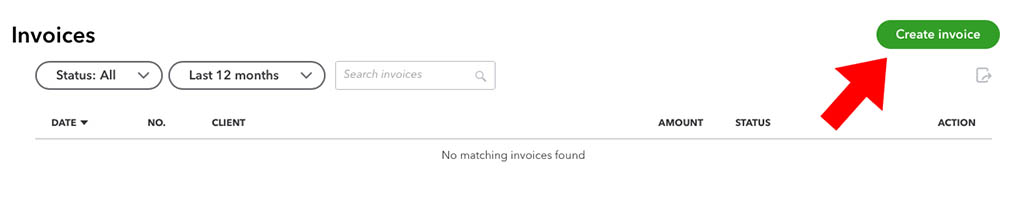

The invoicing tools in QuickBooks Self Employed is more than good enough for freelancers with a relatively small client list. I’ve personally had no problem using Quickbooks to organize my clients and all the associated invoices. Then again, I’ve never had more than 15 clients at a time so it’s been relatively easy to manage. Anyway, this is the process:

All the reasons why I think QuickBooks Self Employed is perfect for freelancers

In addition to all the positive things that I’ve written so far, there are some other points that I feel are important to drive home:

- It’s the low price which makes it absolutely worth it. As I said, it’s only $10 a month at the time that I’m writing this, which is nearly half the price that you would pay for a competitive tool such as FreshBooks.

- It just works. In over five years of using QuickBooks Self Employed, I’ve never once had to go in and fix errors created by the software.

- Support has been very good. The only reason why I’ve ever had to contact them is to find out how to do a certain task, and every time they responded quickly and thoroughly. On a side note, it’s amazing what QuickBooks can do for freelancers. It’s Extremely easy to use and quite intuitive, but my support requests usually conclude by me being amazed by a new feature that I didn’t know about. This is very powerful freelance accounting software!

- This is just a personal thing, but the charts and graphs that QuickBooks Self Employed builds from my income and expense data is incredibly inspiring (even if the numbers are bad). I almost see this visual data as a game. Every month I try to outdo the last, just to see how high (and how big) I can make those charts move. If I was just looking at all this data in a generic spreadsheet, it definitely wouldn’t be as fun. Hey – I’m a simple guy, and I can be motivated by the littlest of things. I’m proud of that!

QuickBooks self-employed FAQs (just for freelancers)

I’m not exactly sure how it happened that I became an expert in all things QuickBooks, but I suppose that it was bound to happen after using it for so long. Anyway, I’ve been receiving a ton of questions from readers about the software ever since I wrote my QuickBooks Self Employed review a short while back. These are the most common questions:

How good is the mobile app?

Honestly, it’s fine and certainly usable for most tasks. No, it’s not that I think that the QuickBooks Self Employed mobile app isn’t well-built or anything. The problem is that managing the finances of a freelance business is detailed work, and there’s only so much you can do on a small mobile phone screen.

I tend to use the app for basic things such as checking the status of my income for the month, seeing where I’m at in terms of taxes due, and checking to see if a certain transaction has gone through. I’m not sending very many invoices these days since my primary business is contact creation, but I can imagine that I’d be using the app a lot more to send and manage invoices if I had clients.

How good is QuickBooks Self Employed for organizing freelancer tax returns?

It’s pretty good. Note that I’m an absolute doofus when it comes to taxes and trying to figure out what I need to pay and by what date, and I need all the help I can get. In that sense, QuickBooks does a really good job of holding my hand and letting me know about deductions I qualify for and getting my taxes paid on time.

Because I’m such a idiot when it comes to this sort of stuff, I still pay an accountant to do my taxes every year just to be safe.

Although, as a freelancer, you should probably be doing the same unless you have total fascination (and maybe a fetish) for filing your taxes every year or quarter. Some people really like that sort of thing, but I know for a fact that I’m not one of them.

Is it really safe to trust QuickBooks with all your personal financial data?

In my opinion, yes. It is. Intuit (who makes QuickBooks) has been around since 1985, and there’s one of the most trusted names in personal and business accounting software.

As I said, I’ve been using QuickBooks Self Employed for well over five years now, and neither my bank or credit cards have ever issued warnings to me about connecting my accounts with QuickBooks.

How long does it take to get QuickBooks Self Employed set up to manage my freelance business?

Assuming that you don’t even have an account yet, plan on about 30 minutes. This is all the time that it takes to create an account and then to link your bank accounts and credit cards. After that, everything runs on auto pilot. QuickBooks Self Employed will use the data from your bank and credit card statements to keep track of and organize your income and expenses.

What do clients feel about paying invoices through QuickBooks?

Personally, I don’t know. All I do know is that I’ve never once had a client refuse to pay me that way. I assume that this means that QuickBooks is a trusted enough name that businesses large and small have no issue using them as a middleman to pay their freelancers and contractors.

As a matter fact, the invoices that a client receives from you have your contact information as the prominent info. The QuickBooks logo and QuickBooks branding is only secondary. Many clients may not even notice it.

How good is QuickBooks Self Employed compared to FreshBooks?

That’s an excellent question, so much so that I wrote an entire article about it. My QuickBooks vs FreshBooks comparison is extremely detailed, and within and I explain all the reasons why I prefer one over the other. Definitely read that if you’re still trying to decide between these two accounting software packages. Spoiler alert: use FreshBooks if you have a very large client list.

Final thoughts

If you are a freelancer who needs help managing your income and expenses, don’t worry. It’s a lot easier to manage than you think – especially with powerful tools such as this.

To end this out, I need to say thatI feel that QuickBooks (technically, Intuit) is doing themselves a disservice by not marketing their Self Employed products towards freelancers. “Self Employed” is a fairly generic term in my opinion, and they’d probably reach a wider audience if they renamed it to “QuickBooks Freelance” or something similar.

But what do I know? I’m just a lowly content creator, so maybe I should just retreat back into the shadows and write another blog post or something…