I’m starting to think that I might have a problem. You see, even though I’ve been an extremely happy QuickBooks user for many years now, I just can’t help but to wonder what my other options are. Last weekend, like a total thrill-seeking tech addict, I found myself digging deep into FreshBooks for the very first time. And now, I feel as if I am bursting at the seams with useful information. I just can’t help but to write this FreshBooks vs QuickBooks review.

For those of you who have absolutely no patience to read an entire article, I’ll just come right out and say it: I prefer QuickBooks.

However, that isn’t to say that FreshBooks is bad. As a matter fact, I actually think that it’s better than QuickBooks in some ways. It’s just that (for me) QuickBooks is the better solution for the type of business that I run (which is non-client based passive income building).

As you might imagine, I’ve got a lot of explaining to do. These are two surprisingly different types of business accounting solutions, and to be honest I didn’t realize that prior to this weekend.

Anyway, let’s start unpacking all this in order to help you decide which one is right for you.

FreshBooks vs QuickBooks: important things you need to know

In order to determine which of these two accounting tools are right for you, you have to know who they were designed for. As I mentioned earlier, I naturally assumed that these were two very similar software packages, but it wasn’t until I dug deep into FreshBooks that I realized that they focus on different things.

What is QuickBooks and who is it for?

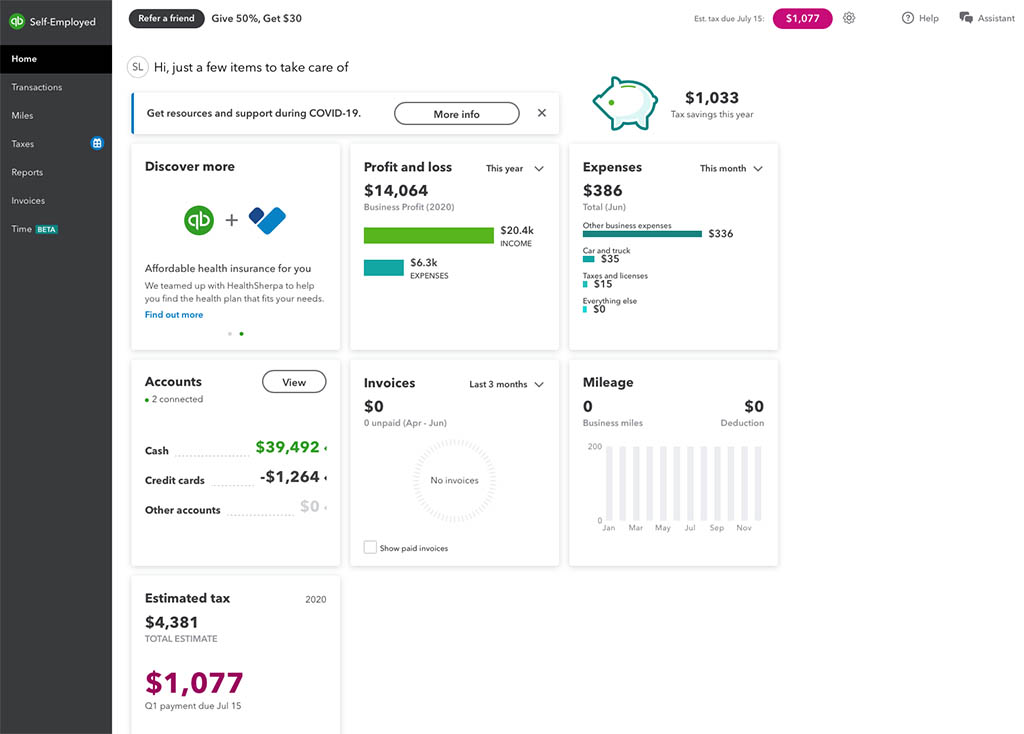

I should let you know that the version of QuickBooks that I use is QuickBooks Self Employed. It’s basically like the regular version, but it places a higher emphasis on things like invoicing and managing quarterly taxes. You can also easily track mileage and many other types of business-related expenses.

This was the first accounting software that I tried back when I became self-employed in 2018. As a single member LLC who focuses on building passive income streams (instead of maintaining a client list), it’s been absolutely perfect and I have no complaints. If you want to read more of my detailed thoughts about this, do be sure to read my full QuickBooks Self Employed review.

In a nutshell: QuickBooks Self Employed is perfect for small businesses with a very small client list. It’s superpower is managing income and expenses, as well as organizing everything when it comes to tax time.

What is FreshBooks and who is it for?

Naturally, I assumed that FreshBooks would be very similar to QuickBooks Self Employed. It is in some ways, and in other ways it is not.

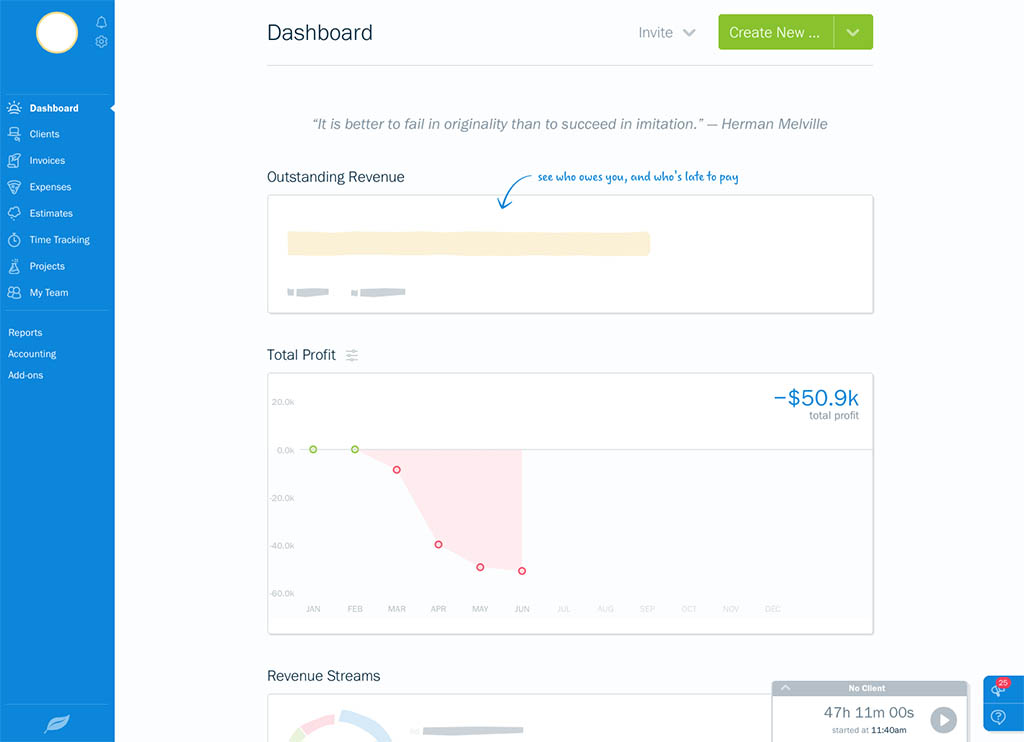

Yes, you can track income and expenses with FreshBooks. However, that’s not why you’d want to use this software. FreshBooks places an extremely heavy emphasis on helping you manage your project and clients. It’s invoicing tools are far more powerful than what QuickBooks offers, and you can even group income and expenses by project or client.

FreshBooks is the perfect accounting tool for freelancers with large client lists.

A brief comparison of QuickBooks and FreshBooks

Because my business revolves around a handful of blogs and YouTube channels designed to produce passive income, I personally don’t have a need for all of the client-centric features of FreshBooks. To help you visualize what I’m talking about, take a look at this FreshBooks vs QuickBooks comparison chart:

| FreshBooks | QuickBooks | |

|---|---|---|

| Income and Expense Reporting |  |  |

| Invoicing |  |  |

| Automatic Quarterly Tax Calculations |  |  |

| Client and Project List Management |  |  |

| Time Tracking |  |  |

| Pricing | $13/$22/$45/mo | $10/mo |

As you can see, QuickBooks Self Employed is for those of you like me who only occasionally deal with clients. FreshBooks is for busy freelancers and contractors who are constantly sending out invoices.

Pros and cons of QuickBooks

I already talked about some of the pros and cons of QuickBooks Self Employed in the review of it that I wrote two years ago, but in order to keep this brief and to the point I’ll try to focus on things which are directly related to this FreshBooks comparison.

Pros

- It’s an incredibly good value for the money. $10 a month is a bargain considering how much time it saves me when it comes time to doing taxes.

- For my business, my primary objective is keeping track of income and expenses. QuickBooks puts this type of functionality in the forefront. I don’t have to go digging for it as I would in FreshBooks. For some reason or another FreshBooks buries that information fairly deep. Not only that, the tools they offer to sort and display that information aren’t as robust IMHO. But I’ll get to that in a moment…

- It’s extremely easy and quick to connect my business banking account and credit cards. I don’t have to manually sync anything. All of that data is imported on its own, and it’s always there when I need it.

Cons

- I’m not a very big fan of how pushy QuickBooks can be with certain things. For example, I don’t necessarily care about things like tracking mileage and knowing how many days until my next quarterly tax payment is. QuickBooks Self Employed insists on pestering with me with this information every time I login, and it’s a bit annoying.

Pros and cons of FreshBooks

I’ll admit it. I am slightly disappointed that the cons section for FreshBooks is a bit longer than the pros. Why? Well, I kept hearing such good things about FreshBooks, and once I tried it, I realized it wasn’t for me. That’s not to say that it’s bad software. Not at all. As a matter fact, depending on what your business structure is like, there’s a very good chance that FreshBooks will be the better solution for you. With that being said, let’s just get right into it:

Pros

- I much prefer the design of the FreshBooks website then I do the QuickBooks website. It’s cleaner, simpler to use, and it feels more snappy and modern.

- Even though the primary objective of my business is to build passive income streams (sans clients), the FreshBooks UI does an amazing job of tempting me to add some clients – just so I can use all of the fancy features that they offer.

- As far as I’m concerned, FreshBooks is the leader when it comes to creating and sending invoices to clients.

Cons

- Compared to QuickBooks, it’s very expensive! As I already mentioned, my primary objective with business accounting software is to track income and expenses. However, that functionality isn’t offered in the basic version of FreshBooks. You’re going to need to sign up for the middle tier if you want to track and manage that kind of data. The heck?

- Personally, I don’t like how the primary focus of FreshBooks is centered around managing client lists. Again, while I see this as a negative, others may see this as a positive. I know that. I’m just giving you my honest opinion that’s all.

- Not only is FreshBooks expensive, it gets even more so when you start adding more clients. They really stick it to you if you’ve got a lot of projects to manage, so you really have to weigh your options before you jump in and commit.

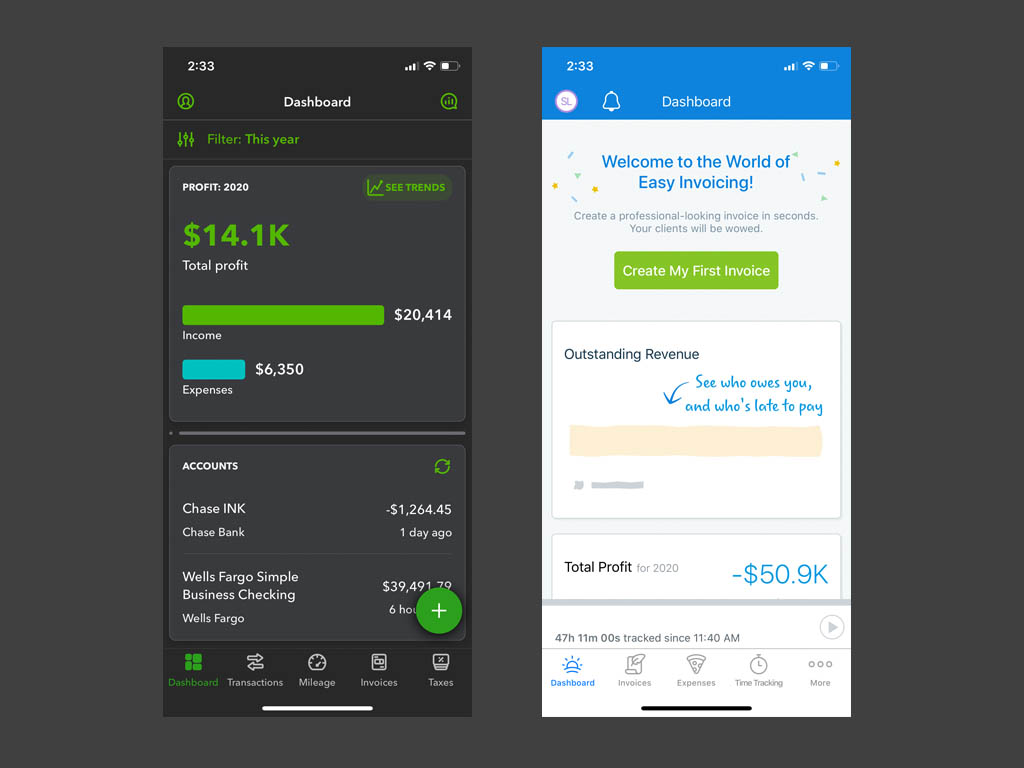

Comparing the mobile apps

The mobile apps of both QuickBooks and FreshBooks are quite good actually. However, I will say that from my particular workflow, I tend to interact with accounting software more on my computer than I do my phone. I much prefer having a bigger screen to get a better look at all the data, and I personally haven’t found much use for the mobile apps yet.

Again, this would likely be very different if I was tracking things like mileage and invoices. Having the ability to interact with and edit that type of information when I’m out and about (away from my computer) would be very useful I’m sure. However, I spend 99% of my time in front of my computer at home and these features are of little use to me.

QuickBooks mobile app

I am a total stats freak (if you haven’t been able to tell from reading my income reports), so I love the fact that the dashboard of the QuickBooks app displays a summary of my current financials for whatever time period I choose. I always like to know where I stand when it comes to money flowing in and out, and that is my primary use of this app at the moment.

However, do note that the QuickBooks mobile app can do so much more than that. As far as I can tell, nearly all of the features that you get on the desktop version are available on the mobile version. You can create and send invoices, track mileage, and organize both income and expenses on the fly.

FreshBooks mobile app

This is the part of the FreshBooks vs QuickBooks comparison where I start getting a little bit confused. As I wrote earlier, one of the reasons why I felt that FreshBooks wasn’t for me was the fact that they put such a little emphasis on income versus expenses tracking. At least that’s what I thought until I downloaded their mobile app.

As you can see below, the main page if their mobile app is very similar in layout to the way QuickBooks does it. There’s a beautiful summary of income vs expenses for the chosen time period, with useful charts and graphs showing me all the stuff I want to see.

My question is this: why can’t I configure the desktop version of FreshBooks to summarize data like this? Because managing client lists and sending invoices isn’t my main priority in my business, I want to see where I stand (right down to the penny) when it comes to income vs expenses. You’ve really got a dig for it on their website, which seems to be a much different approach compared to the mobile app.

Can FreshBooks and QuickBooks self-employed be used as personal accounting software?

Yes and no. Neither FreshBooks nor QuickBooks Self Employed was designed to be used as personal accounting software. You could probably do it if you were hell-bent on making it work, but the way that both organize income and spending into tax-friendly categories makes it cumbersome.

For example, there are no categories for things such as groceries stores and medical bills on either platform. This is because these aren’t business-related tax categories, and therefore neither of these products will categorize such income accordingly.

Yes, you can add each category manually, but it’s a total pain in the rear. You’re far better off using dedicated personal accounting software since all that stuff will be built in natively. It’s gonna save you tons of time.

That being said, here are a few specific things about FreshBooks and QuickBooks which make them cumbersome to be used as personal accounting software:

Quickbooks as a personal accounting solution

Using QuickBooks Self Employed as personal accounting software is doable (to a point).

- It tracks income and expenses effortlessly

- It summarizes everything into organized categories on its own (you’ll have to create your own categories for things such as groceries and medical bills though)

- You can securely connect all of your bank and credit card accounts with just a few clicks of a button.

- It’s fairly limited when it comes to helping you manage your savings and investment accounts. As a matter of fact, I don’t think there’s anything in QuickBooks Self Employed which tracks investment and asset data.

FreshBooks as a personal accounting solution

Again, the biggest problem with FreshBooks is that it tries to hit you over the head with invoice and features every time you open the app or go to the website.

- Invoicing is something that most people would never need for personal accounting software, so FreshBooks will be a no-go for most.

- Making it even worse is the fact that it’s income and expense tools are far more basic than what you would get in QuickBooks Self Employed.

I guess if I was forced to make a FreshBooks vs QuickBooks decision for use as personal finance software, I would give the nod to QuickBooks. However, it would be a non-enthusiastic nod indeed. There’s far better software for that sort of thing.

Why isn’t FreshBooks the right accounting solution for me?

Basically, it all comes down to the fact that I am a highly-introverted entrepreneur who likes to work alone. I have very few clients, and my need to send out invoices on a regular basis is minimal.

I will say that FreshBooks would likely be my primary choice of business accounting software if I was an active freelancer or contractor with a large client list. I’ve never seen such a powerful invoicing and client managing tool that is as easy to use as this, and I highly recommend it if those are the kinds of features that you need.

But for now, I will continue to use QuickBooks Self Employed. It does everything I need at a very fair price, and I’m not feeling the need to switch over to anything else at this point.